The Ultimate Brand Accelerator? Data

Private equity has long been built on relationships, financial know-how, and strategic vision. But today, data science is transforming the game.

At Newcastle, we believe leveraging data, analytics, and AI isn’t just an advantage—it’s a necessity. From identifying high-potential brands to driving operational excellence, data is the foundation that powers our investment approach and helps supercharge our portfolio companies.

Investing with Data: Smarter, Faster, and More Effective

Newcastle invests in middle-market consumer brands with strong customer flywheels, i.e. businesses with existing loyalty and growing consumer bases. Data science is the key to unearthing and sustaining this momentum. Our approach enables us to:

Identify promising brands with greater accuracy and speed (sourcing)

Structure smarter partnerships that maximize value across our network (diligence)

Unlock the full potential of our portfolio companies’ data assets (execution)

Why Consumer Brands Need Data Science

The consumer landscape is complex—highly diverse, volatile, and competitive. The brands that harness data effectively gain an edge by making sharper decisions, personalizing customer experiences, and scaling efficiently.

Diversity: Today's consumers are more empowered than ever. They expect convenience, choice, speed, and personalization, raising the bar for brands. To build trust and loyalty, brands must deliver value at every interaction by leveraging data to understand and anticipate their customers' evolving needs.

Volatility: The $17T U.S. consumer sector is unpredictable, with social media trends and shifting sentiment creating constant change. Brands need data science to detect patterns early and adapt quickly.

Competition: Digital platforms and abundant capital have lowered barriers to entry. A well-built data engine allows brands to punch above their weight, allocating resources strategically to outpace competitors.

The Data Gap in Middle-Market Consumer Brands

Despite data’s potential, consumer brands regularly underutilize it. Why? Fragmented systems, siloed information, and a lack of dedicated analytics talent. Many brands track high-level metrics (like return on ad spend and conversion rates) but lack the deeper insights that drive long-term success.

At Newcastle, we’ve built a proprietary operating system—foundational data, analytics, and AI-powered system that enhances every step of our investment process.

1. Discover Opportunities

Our system simplifies the collection and retrieval of intelligence, embedding insights directly into our workflow. With AI-enhanced tools, logging or analyzing a deal is as easy as messaging a teammate in Slack.

2. Increase Efficiency

We automate and streamline due diligence, brand data ingestion, diagnostics, dashboards, and investment memos. This efficiency helps us dive deeper into potential investments earlier, generating more opportunities at the top of the funnel.

3. Deliver Value

Our approach systematically reduces bias, improving underwriting accuracy and risk assessment. We integrate new data sources and models continuously, creating feedback loops that refine our decision-making.

How Our Data-Driven Approach Works

We know stronger decisions come from better data. That’s why we’ve built a systematized, transparent, and insight-rich approach to how we evaluate and support brands—from the first conversation through long-term partnership.

Diligence: Measuring Brand Momentum

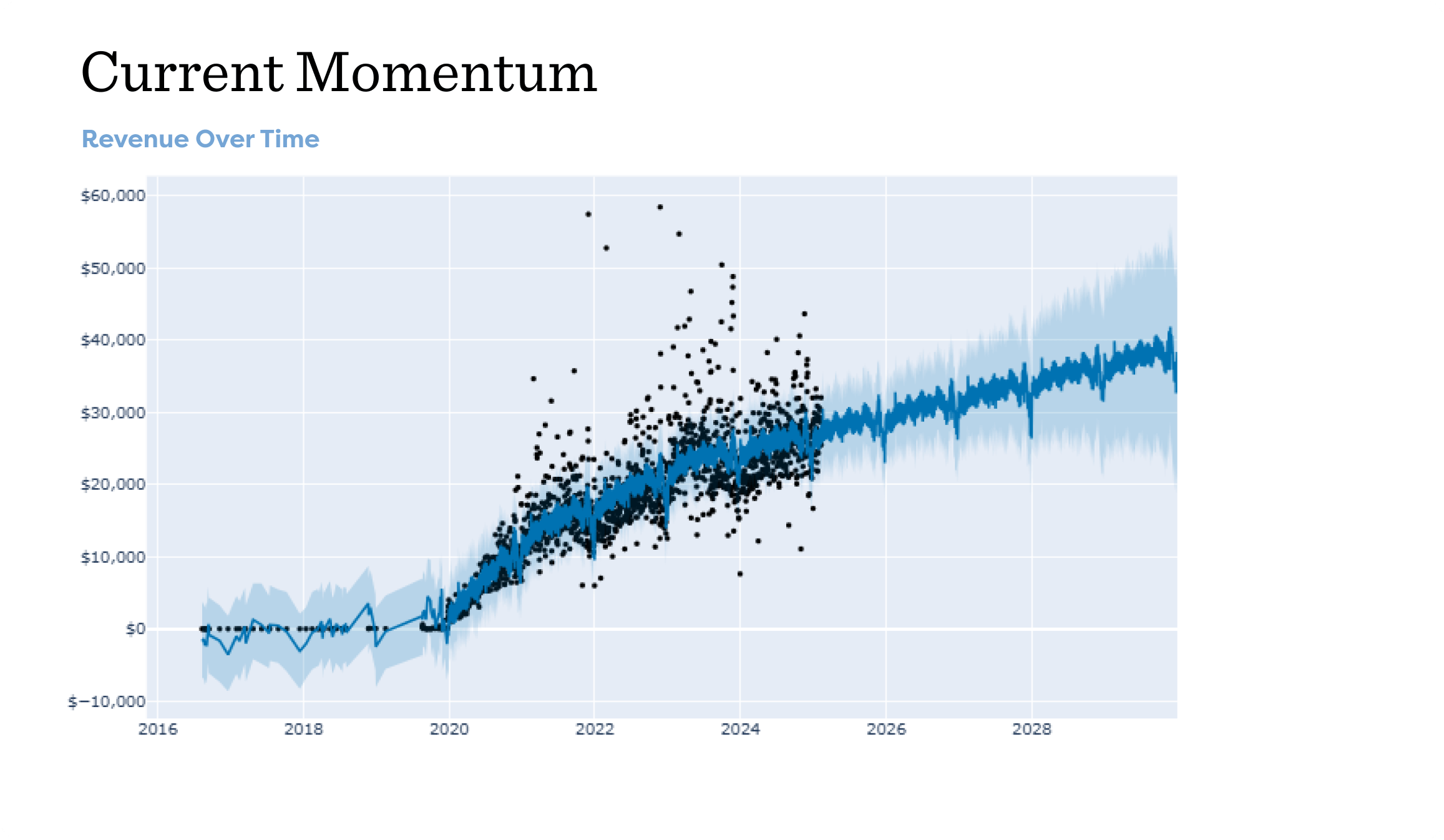

A core component of our diligence process is understanding a brand’s momentum—broken down into three key areas: (1) New customer acquisition over time, (2) initial spending patterns of new customers, and (3) lifetime value and repeat purchasing behavior.

To evaluate these factors, we analyze every transaction, product sale, and marketing dollar spent. We request direct, read-only access to key platforms (Shopify, Amazon, Google Analytics, Meta, etc.) and extract data automatically. This allows us to track the underlying trends across a brand’s momentum key drivers (customer growth, initial spend, and repeat behavior) to give us a solid baseline for performance.

Together, these drivers produce a revenue forecast that supports our portfolio investment decisions while giving brands a clearer understanding of their current business dynamics.

We package these findings and share them with the company—providing transparency into our valuation assumptions and the flexibility to adjust. Even if a deal doesn’t move forward, brands retain access to these insights to monitor their own trajectory.

Value Creation: Data-Driven Decision Making

Once a transaction closes, our work has just begun. We continue to evaluate and incorporate additional commercial and proprietary datasets, models, and tools to unlock strategic insights and drive operational improvement.

We deliver a level of consistency and transparency in both our analytics and reporting, which is crucial to building long-term alignment and confidence across teams and functions.

Pipeline: Offering Data Insights Early

Our automation enables us to offer prospective portfolio companies a complimentary brand assessment—a “mini-diligence process” that delivers valuable insights upfront. It’s win-win:

Brands benefit from actionable recommendations, powerful data tools, and a preview of what it’s like to partner with us.

Newcastle benefits by evaluating more brands earlier, refining our analytics, and expanding our benchmarks, while ultimately delivering more value to the brands we engage.

The Future of Private Equity is Data-Driven

At The Newcastle Network, we’re not just investors—we build data-driven growth engines. By integrating data science at every stage of our investment process, we identify stronger investments, drive efficiencies, and help portfolio companies realize their potential. The future of private equity isn’t just about capital—it’s about intelligence, agility, and the power of data to unlock extraordinary value.

Michael Kesselman,

Partner

Michael is the architect behind Newcastle’s internal operating system that quietly powers everything from our investment stage gates to the tools, data, and systems that help our team and portfolio companies work smarter. View profile.